Schwartsman & Associados

As widely expected, BCB started the easing cycle, but reducing the target for the

benchmark Selic rate by 50bps, to 13.25% per annum, whereas most analysts, myself

included, anticipated a more modest reduction, to 13.50% per annum. That said, the

Committee itself was almost evenly split, as 5 of its members, including Governor

Roberto Campos, opted for the larger cut, while the remaining 4, including both current

and former Deputy Governors for Economic Policy, Diogo Guillen and Fernanda

Guardado, precisely those more experienced in the subject, voted for a 25bps cut.

More importantly, the Committee unanimously signaled that further 50bps moves

would take place in incoming meetings (more on that below), provided the scenario

unfolds as expected.

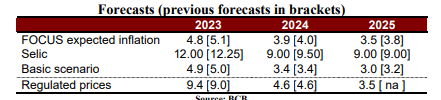

Having said that, BCB’s basic scenario has changed less than I had expected. My

estimates suggested that BCB’s forecast for inflation in 2024 would fall from 3.4% to

3.2%, whereas its projection for 2025 would reach 2.9% from 3.2% earlier.

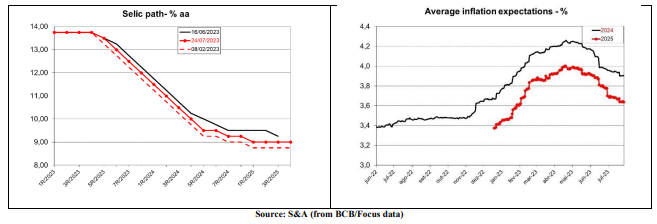

As shown above, however, the forecast for 2024, which, by the way, embedded a more

moderate reduction in the policy rate (below at the left), remained unchanged at 3.4%,

while 2025 inflation would be right on the target, 3.0%. Yet, assuming that the Selic

rate would change by the same magnitude expected before the meeting, but departing

from 13.25%, rather than 13.50%, we would have a path for the Selic rate as depicted

below, providing less of a contractionary impact than the previously expected path.

To be sure, BCB makes it clear that monetary policy must remain contractionary, that

is, with real interest rates above the so-called neutral rate (currently estimated at 4.5%,

which, added to the inflation target at 3.0% would mean a nominal neutral rate around 7.5% per annum) along the disinflationary period. In its own words:

“The Committee reinforces the need to maintain a contractionary monetary

policy until not only the disinflation process is consolidated but also inflation

expectation expectations reach around its targets.”

As shown above, at the right, there is still some way to go regarding inflation

expectations, which, despite some decline since May, remain well above the 3% target.

While the rationale for the bolder move now has not been revealed (the justification for

opting for 50bps rather than 25bps basically repeats the same reasons for starting the

easing cycle), the Committee has refrained from taking a victory lap regarding inflation.

Indeed, it states that:

“The current stage, characterized by a slow disinflationary process and by

inflation expectations only partially anchored, demands serenity and

moderation in the conduct of monetary policy.”

We are splitting hairs here (but, when it comes to Copomspeak, no detail is small

enough), “serenity and moderation” seem a bit more dovish (or, if you prefer, less

hawkish) than “caution and parsimony”, more in line with a central bank that is about

to embark an easing cycle that, while still contractionary, is likely to bring rates back to

single digit territory by mid-2024.

And, since we are on the subject, BCB has also altered somewhat its balance of risks,

eliminating two of the upside risks to inflation (the approval of the new fiscal

framework, and unmoored inflation expectations) and two of the downside risks (the

additional decline in commodity prices and stronger than expected contraction of

domestic credit), while adding one new upside risk (higher resilience of services

inflation) and a new downside risk (the impacts of a synchronized global monetary

tightening). At any rate, however, there are no indications of a possible asymmetry

regarding the inflation outlook.

At the end of the day, I cannot hide some frustration at the decision. Not the decision,

per se, although it was not my call, but more with the fact that there was no strong

justification for the larger cut at this moment. Had forecasts declined, in particular more

than I anticipated, or had BCB come up with a forceful case for a bolder start, I would

not feel as uncomfortable as I am right now (and I repeat, this has little to do with the

decision itself).

Maybe the key for understating it lies in the following expression (which, by that way,

was present in the June statement: “[The Committee] understands that this decision is

compatible with a strategy of inflation convergence around the target along the relevant

horizon”. BCB seems content in pushing inflation to the neighborhood of the target,

rather than the target itself.

In that case, as long as forecasts are close to the target, BCB is likely to keep trimming

the policy rate. I expect, thus, it to fall to 11.75% per annum in December 2023. As for

December 2024, under normal circumstances, I would put it at 9.00% per annum, but,

given the impending change of guard at the end of next year, I still have reservations

about 2025 expectations converging back to the target, with implications for 2024

inflation as well.

In any case, I maintain that the Selic rate would fall to single digit levels by mid-2024,

possibly 9.50-9.75% per annum.

As opiniões aqui expressas são do autor e não refletem necessariamente as do CDPP, tampouco as dos demais associados.